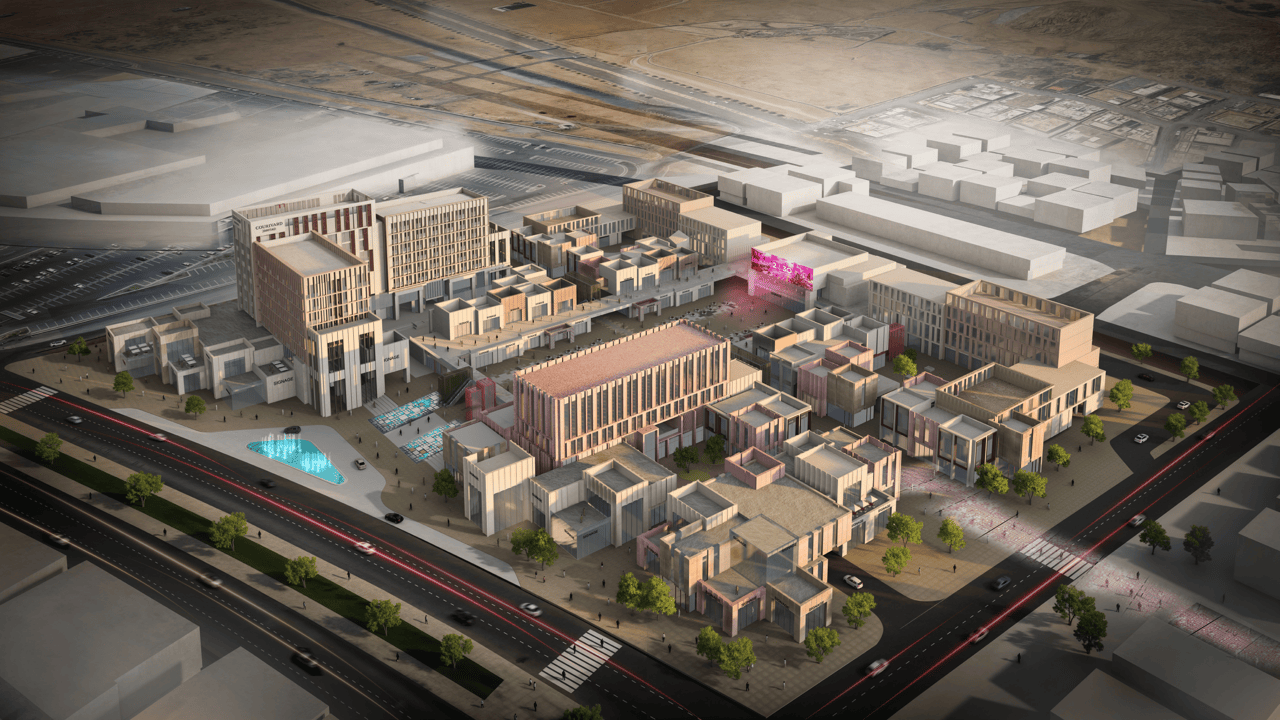

AWJ Real Estate and Seef Properties Join Forces to Launch a SAR 1.5 Billion Mixed-Use Destination in Riyadh.

We are pleased to have signed a strategic Memorandum of Understanding with Seef Properties, one of the leading real estate development companies in the Kingdom of Bahrain, to jointly develop a dynamic, mixed-use urban destination in the heart of Riyadh.

This project is part of our broader vision to develop iconic and high-impact destinations within Al Rabwa district, which includes “Al Rabwa Boulevard” and the “SEVEN” entertainment destination currently under development by Saudi Entertainment Ventures, alongside other strategic projects to be unveiled soon.

The new destination will be located within one of our major developments in Riyadh, where we have already successfully delivered over 3,000 residential units in earlier phases in collaboration with top-tier real estate developers across the Kingdom. In the next phase, we aim to deliver more than 7,000 additional and diverse residential units.

Spanning over 160,000 square meters, the project is valued at approximately SAR 1.5 billion. Our vision is to create a fully integrated urban destination featuring family entertainment centers, cafés and restaurants, office spaces, and residential units — all designed to meet the highest standards of sustainable urban development.

This partnership reflects AWJ’s continued commitment to shaping the future of urban living and reinforces its leadership in Saudi Arabia’s real estate sector.

AWJ-Backed Almajdiah Leverages Local Real Estate Expertise to Power One Of 2025’s Largest IPOs

AWJ Investments “The investment arm of AWJ Holding” stands at the forefront of Saudi Arabia’s real estate transformation, leveraging a thematic investment strategy to unlock access to a fully-integrated, powerful ecosystem that accelerates breakout success and creates tangible value for its portfolio companies.

Dar Al Majed Real Estate’s “Almajdiah” IPO closes within minutes valuing the company at SAR 4.2 Bn, which is a testament to the local expertise, strong market sentiment, and investor confidence

In 2022, AWJ acquired a 7.5% stake in Almajdiah, a leading Saudi developer which has built a sizeable footprint in the Saudi real estate market and became a local household brand. AWJ leveraged its in-house talent, platform data access, and significant real estate portfolio while supporting Almajdiah’s journey to achieving its first major milestone. AWJ reaffirms its commitment to supporting Almajdiah through its next phase of growth focused on innovation and sustainability.

Almajdiah confirmed the Saudi Exchange (Tadawul) listing at SAR 14 (USD 3.73) per share in an oversubscribed initial public offering that floats 30% of the capital. The company plans to raise SAR 1.26 billion (USD 336 million) setting the total enterprise value at a remarkable SAR 4.2 billion (USD 1.11 billion).

BSF Capital was mandated as the Lead Manager, Joint Financial Advisor, Bookrunner, and Underwriter.

About Dar Al Majed Real Estate

Established in 2014, Almajdiah was founded as a residential developer tapping into the housing shortage in Saudi Arabia which gradually expanded into commercial real estate development. As of 2024, the Riyadh-based firm developed 2.5 million square meters across 180 sizeable projects comprising over 18,000 units. Almajdiah currently has 130 employees and recently expanded its business by launching property management and real estate brokerage verticals.

Al Taif Plaza is a premium mixed-use development located in Saudi Arabia’s Western Region.

The project features retail and F&B spaces, modern offices, and a Marriott-operated hotel, creating a vibrant destination for business, leisure, and lifestyle. It reflects G1’s commitment to delivering high-quality, integrated urban developments that support the Kingdom’s growth and modernization

51,271 M 2

Area

62,564 M 2

Built-Up Area

52,799 M 2

Gross Leasable Area

Taif

Location